DEA Seizure of Cash at the Airport

Did the Drug Enforcement Administration (DEA) seize your cash or other property? If so, you have come to the right place because we can help you file a claim to get your money back quickly.

The civil asset forfeiture attorneys at Sammis Law Firm are particularly experienced with fighting DEA seizures for forfeiture of cash at airports throughout Florida and the rest of the United States.

We take these cases on a contingency basis, which means you pay nothing in attorney fees unless we help you recover your seized property.

In addition to the airport, DEA agents target travelers with cash at Amtrak train stations, Greyhound bus stations, and the highways. Cash might also be seized during the execution of a search warrant or arrest warrant.

Sometimes, DEA will seize money directly from a bank account or safe deposit box. In addition to cash, DEA agents might also seize cryptocurrency, including Bitcoin. No matter the circumstances, our civil asset forfeiture attorneys can help you fight to get the property back.

Experienced attorneys who fight forfeitures by the DEA can fight to get the seized U.S. Currency back quickly, especially when no arrest was made, and no criminal charges are pending.

Call us to find out why it might be best to opt out of the DEA’s administrative forfeiture proceedings and instead demand court action by filing a verified claim. Demanding court action is the ONLY way to challenge the legality of the initial seizure.

An attorney can help you contest the action by filing a claim demanding early judicial intervention or court action in the U.S. District Court.

Don’t waive your rights to a judicial referral for court action by filing an administrative petition for remission or mitigation until you understand the downsides to that approach.

Attorneys for DEA Cash Seizures at Airports in Florida

If DEA agents took your money, vehicles, jewelry, or other valuable assets, then contact an experienced criminal defense attorney to fight for the return of the property. Contact us for a free and confidential consultation in the office to discuss the case.

Our main office is in Tampa, FL. We work with attorneys across the United States to fight DEA currency seizures.

We can help you file a claim for immediate court action or an adverse preliminary hearing showing that the property was illegally seized or the forfeiture was otherwise illegal.

Attorney Leslie Sammis in Tampa, FL, is particularly experienced in fighting the seizure of cash by DEA agents at airports throughout the county. In some cases, Ms. Sammis teams up with other local attorneys in the jurisdiction where the money was seized.

We also represent clients after a seizure for forfeiture at an Amtrak train station or bus station.

The asset forfeiture attorneys in Tampa, FL, at Sammis Law Firm also represent clients in cases involving the Florida Contraband Forfeiture Act in forfeitures proceedings in state court.

Contact us to learn more about the authority for forfeitures under state or federal law, important defenses that apply, and the best way to fight for the immediate return of your property.

We welcome your calls. Call 813-250-0500 today.

What Happens When DEA Seizes Cash or Property at the Airport?

If you bring cash to the airport, the DEA might seize the U.S. Currency for forfeiture. If a local law enforcement agency seized the property, DEA might “adopt” the property for forfeiture under 21 U.S.C. 881.

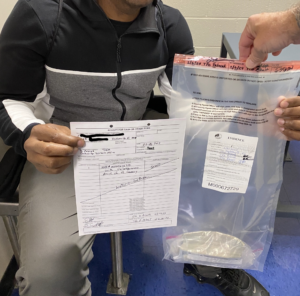

After the property is seized, you should receive a receipt. The DEA agent might tell you that a personal “notice of seizure” will arrive in the mail within 60 days. You do not have to wait for the personal notice to arrive.

At Sammis Law Firm, we immediately file a verified claim for court action to contest the legality of the forfeiture action, sometimes the day after the seizure. Making the demand early means that the money might be returned much sooner.

A few weeks after we make the first claim, we typically receive a letter from the DEA’s Supervisory Program Analyst of the Asset Forfeiture Section in the Office of Operations Management acknowledging that:

- DEA received the submission;

- the claim has been accepted; and

- the matter has been referred to the Assistant United States Attorney (AUSA) in the appropriate judicial district.

At the same time, the DEA will send the AUSA a memorandum for the “Judicial Referral of Seized Assets.” If the claim is filed before the personal notice goes out (before notice commencing), then the CATS will often show that the referral is designated as “notice not required.”

The memorandum from DEA will list a description of the property, the judicial district, the asset I.D. number, and the case number. Hopefully, the letter lists the correct amount of money seized.

Letter from DEA – Notice of Seizure and Forfeiture Proceedings

Within 60 days of the seizure, DEA is required to send you a letter entitled the “Notice of Seizure of Property and Initiation of Administrative Forfeiture Proceedings” from the U.S. Department of Justice (DOJ), Drug Enforcement Administration (DEA).

The notice warns you that failing to file a claim within the time allowed may result in the seized property being forfeited to the United States Government.

The form will list the identifying information of the seized property, including:

- the date of the notice;

- the asset ID number;

- the description of the property;

- the asset value; and

- the forfeiture authority.

You should fight to get the property back. You can and should hire an attorney to immediately file a claim for court action. You are not required to wait for the DEA’s Notice of Seizure letter to arrive in the mail.

What happens if you don’t get the notice of seizure letter from DEA? The agency might argue that you missed the deadline even if you never got the notice of seizure because they also publish it online at the forfeiture.gov website.

Asset Seizure and Forfeitures Under 21 U.S.C. 881

When the DEA takes property, the notice will usually claim that the forfeiture of the property is under 21 U.S.C. 881 and the following additional laws:

- 19 U.S.C. Section 1602-1619;

- 18 U.S.C. Section 983; and

- 28 C.F.R. Parts 8 and 9.

Stringent deadlines apply in these cases, especially if you are filing a verified claim for court action or judicial referral. If you miss the deadline, your chance of getting the property drops significantly.

Keep in mind that your correspondence will be deemed filed or submitted on the business date is received by the Forfeiture Counsel.

A facsimile transmission (fax) is NOT considered filed or submitted. Hiring an experienced attorney to send the demand on time is the best way to ensure your rights are protected, and your property is returned without any undue delay.

Statistics on When Property is Given Back After a DEA Seizure

DEA has seized more than $2 billion in U.S Currency during the past five years. More than $200 million of those funds were seized by DEA interdiction Task Force Groups in thousands of individual currency seizures.

DEA seizures of cash at the airport are particularly common. The DEA nicknamed its airport interdiction activities and interdiction training course “Operation Jetway.” Critics call it “Jetway Robbery.”

If a local law enforcement agency seizes the property, the DEA might “adopt” the property for forfeiture pursuant to 21 U.S.C. 881.

The government’s own audit published in March of 2017 shows that after a cash seizure, DEA gives the money back less than 9% of the time. The study also found that the DEA returned only 4% of the value of seizures made between FY 2007 and FY 2016.

A report published in March of 2017, entitled “Review of the Department’s Oversight of Cash Seizure and Forfeiture Activities” from the Evaluation and Inspections Division 17-02 of the Office of Inspector General at the U.S. Department of Justice, found:

Given the volume of DEA cash seizures, we analyzed how much of the DEA’s seized cash was forfeited and deposited into the Department’s Assets Forfeiture Fund versus being returned to the individual from whom the asset was seized or to another party such as an owner, lienholder, or crime victim.

Of the DEA’s 80,141 cash seizures that occurred between FYs 2007 and 2016, a claim or a petition was filed for 15,867 (20 percent). Of these 15,867 seizures with a related claim or petition, 6,232 (39 percent) resulted in a full or partial return.

The DEA also returned part or all of an additional 492 cash seizures for which it had not received a claim or a petition.

Overall, the DEA returned all or part of 6,724 cash seizures, or 8 percent of the seizures it made, between FYs 2007 and 2016.

In terms of value, we also found that the DEA returned approximately $153 million of its cash seizures, while approximately $3.8 billion was forfeited and deposited into the Department’s Assets Forfeiture Fund.

Because of how the DEA kept data, the study could not determine the breakdown of the difference between how money was returned in response to a petition for administrative action when compared to a claim demanding court action.

Contesting the Forfeiture in U.S. District Court

You must file a claim to contest the forfeiture of the property in the United States District Court. If you do not file a claim, you will waive your right to contest the forfeiture of the asset.

If no other claims are filed, you may not be able to contest the forfeiture of the asset in any other proceeding, criminal or civil.

Although you do not need an attorney to contest a DEA forfeiture action, you are entitled to have an attorney represent you at every stage of the case. The attorney can help you fight for the immediate return of your property.

The attorney can also ensure you are not subjected to burdensome discovery requests by the Government that serve no purpose other than to embarrass or harass you.

You must contest the forfeiture by filing a claim for property seized by the DEA. The claim should be filed by mailing it through the U.S. Postal Service and also sending it via Commercial Delivery Service (FedEx or UPS) to the Drug Enforcement Agency Administration (DEA) at the address listed in your notice.

Forfeiture Counsel for the DEAAsset Forfeiture Section of the DEA

8701 Morrissette Drive

Springfield, VA 22152

The letter explains that any further correspondence sent to DEA regarding this matter must reference the DEA case and asset identification number and be addressed to the Forfeiture Counsel, Drug Enforcement Administrative, Asset Forfeiture Section, 8701 Morrissette Drive, Springfield, Virginia, 22152.

The letter provides that correspondence will be deemed filed or submitted on the business day in which the Forfeiture Counsel receives it at the address listed above.

Correspondence will not be accepted nor considered filed on weekends or federal holidays or when it is received by any other office or official, such as a court, United States Attorney’s Office, or local DEA office.

In addition, a Claim or Petition sent to the DEA is not considered filed if received by facsimile transmission.

Finally, correspondence to the DEA is not considered filed or submitted on the date it is mailed or delivered to any person for delivery to the DEA’s Forfeiture Counsel.

DEA’s Acknowledgment of the Verified Claim Contesting the Forfeiture

After your claim is filed, your attorney will receive written acknowledgment of the claim from the Office of Operations Management with the DEA’s Asset Forfeiture Section.

The DEA’s acknowledgment of the claim will list the Asset I.D. No.: 22-DEA-xxxxxx, Case Number, the Property, a specific amount of U.S. Currency, and the Judicial District. The letter further provides:

The Drug Enforcement Administration (DEA) has received the submission regarding the above-referenced asset(s). The following information is provided:

The claim has been accepted and this matter has been referred to the judicial district noted above. Please direct all inquiries regarding this matter to that office.

If you wait to receive the personal notice letter provided in accordance with U.S.C. Section 983(a)(2), then you must file any claim within thirty-five (35) days of the date of the letter.

Be sure to properly serve the notice because the claim is deemed filed on the date received by the Forfeiture Counsel in the DEA’s Asset Forfeiture Section at the address listed in the notice.

Legal Requirements for the Asset Forfeiture Claims

To fight for the return of property seized by the DEA, you must file a claim that complies with the following requirements:

- the claim must be in writing;

- the claim must describe the property taken;

- the claim must state your ownership or other interest in the property; and

- the claim must be made under oath and subject to the penalty of perjury.

The requirements for filing the claim are listed in U.S.C. Section 983(a)(2)(C) and 28 U.S.C. Section 1746.

The claim does not need to be made in any particular form, but a claim form is available at www.forfeiture.gov, which you may print and deliver to the DEA’s Forfeiture Counsel in the asset forfeiture section of the DEA as required in the notice.

Although not required, you can support your claim by submitting supporting evidence, such as the title paperwork or bank records showing your interest in the seized property.

Filing the claim promptly stops the administrative forfeiture proceeding. The DEA must timely forward the claim to the U.S. Attorney’s Office for further proceedings.

If you intentionally file a frivolous claim, you may be subject to a civil fine as specified in 18 U.S.C Section 983(h). If you intentionally submit a claim containing false information, you may be subject to prosecution as provided in 18 U.S.C. Section 1001.

Failure to file the claim within the allotted time may result in the United States government forfeiting the property.

How to Release the Property Based on a Hardship

After filing a proper claim for property seized by the DEA, you may request the release of the seized property during the pendency of the forfeiture proceeding due to hardship if you meet specific conditions set out in 18 U.S.C. Section 983(f) and 28 C.F.R. Section 8.15.

The hardship request must be in writing and establish the following:

- you have a possessory interest in the property;

- you have sufficient ties to the community to assure that the property will be available at the time of trial; and

- the Government’s continued possession will cause a substantial hardship to you.

You can find a complete list of the hardship provisions at 18 U.S.C Section 983(f) and 28 C.F.R. Section 8.15. Some assets are not eligible for release.

The DEA’s Civil Forfeiture Proceedings

Civil forfeiture proceedings are governed by statute, the Federal Rules of Civil Procedure, and the Supplemental Rules for Admiralty or Maritime Claims and Asset Forfeiture Actions (“Supplemental Rules”).

Certain property is subject to forfeiture by the United States under 21 U.S.C. § 881. The United States Attorney General may elect to seek criminal forfeiture under 18 U.S.C. § 982 or civil forfeiture under 18 U.S.C. § 983.

Criminal forfeitures operate in personam against the defendant and serve as a penalty upon conviction. Civil forfeitures operate in rem against the property “under the theory that the property is guilty of wrongdoing.” See United States v. Duboc, 694 F.3d 1223, 1228 (11th Cir. 2012).

In a civil forfeiture proceeding, the property owner’s culpability is not considered in determining whether the property should be forfeited.

While a conviction is necessary to uphold a criminal forfeiture, a conviction is irrelevant in a civil forfeiture proceeding. 3 Crim. Prac. Manual § 107.4 (2012).

DEA Forfeiture under 21 U.S.C. 881

The Civil Asset Forfeiture Reform Act of 2000 (“CAFRA”), 18 U.S.C. § 983(c), sets forth the Government’s burden of proof in a civil forfeiture action. Under CAFRA, it is the Government’s burden to show by a preponderance of the evidence that forfeiture applies. 18 U.S.C. § 983(c)(1).

Section 881 provides, inter alia, for the forfeiture to the United States of property used in the commission of federally controlled substance violations punishable by more than one year in prison. See 21 U.S.C. § 881.

When the DEA seeks forfeiture under 21 U.S.C. § 881(a)(6), federal DEA agents might claim that the money falls in one of the following categories:

- furnished or intended to be furnished by any person in exchange for a controlled substance;

- traceable to such an exchange; or

- used or intended to be used to facilitate any violation of this sub-chapter.

Although the Government must meet this burden at trial, it is not necessarily required to meet it at the pleadings stage.

Both CAFRA and the Supplemental Rules state that a complaint may not be “dismissed on the ground that the government did not have adequate evidence at the time the complaint was filed to establish the forfeitability of the property.” 18 U.S.C. § 983(a)(3)(D); Fed. R. Civ. P. Supp. R. G(8)(b)(ii).

In a civil forfeiture proceeding, the government bears the burden of establishing by a preponderance of the evidence that the property is subject to forfeiture.

Suppose the government’s theory is that the property was used to commit or facilitate the commission of a criminal offense. In that case, the government must establish that there was a substantial connection between the property and the offense.

The courts have explained the civil forfeiture provision of the Controlled Substances Act, 21 U.S.C. § 881(a)(6), as follows:

Civil forfeiture standards are now subject to the Civil Asset Forfeiture Reform Act of 2000 (“CAFRA”), 18 U.S.C. § 983(c)(1). CAFRA heightens the government’s evidentiary burden in civil forfeitures—the government must demonstrate by a preponderance of the evidence that the property sought is subject to forfeiture….

Furthermore, § 983(c)(3) provides that ‘if the Government’s theory of forfeiture is that the property was used to commit or facilitate the commission of a criminal offense, or was involved in the commission of a criminal offense, the Government shall establish that there was a substantial connection between the property and the offense.’

United States v. Funds in Amount of Thirty Thousand Six Hundred Seventy Dollars, 403 F.3d 448, 454 (7th Cir. 2005) (internal citations omitted).

A claimant’s “cash hoard may be subject to forfeiture if the currency at issue represents the proceeds of an illegal drug transaction or was intended to facilitate such a transaction.” Id. at 454.

District Courts enjoy original subject matter jurisdiction over civil forfeiture proceedings via 28 U.S.C. §§ 1345 and 1355. See, e.g., United States v. Marrocco, 578 F.3d 627, 632 n.3 (7th Cir. 2009). Venue lies, inter alia, under 28 U.S.C. § 1395, which includes “any district where such property is found.”). See 21 U.S.C. § 881(j).

Motion to Dismiss the Forfeiture under Supplemental Rule G(8)(b)

In an action for civil forfeiture in rem, as to which the Supplemental Rules for Admiralty or Maritime Claims and Asset Forfeiture Actions apply, the claimant can bring a motion to dismiss the forfeiture under Supplemental Rule G(8)(b), which allows a claimant with standing to move to dismiss a forfeiture action under Federal Rule of Civil Procedure 12(b)(6).

Under Fed. R. Civ. P. Supp. R. A(1)(b), the Supplemental Rules are part of the Federal Rules of Civil Procedure and govern procedures in civil forfeiture actions. The Federal Rules of Civil Procedure also apply to such actions to the extent they are not inconsistent with the Supplemental Rules. Fed. R. Civ. P. Supp. R A(2).

Fed. R. Civ. P. 12(b)(6) allows dismissal if a plaintiff fails “to state a claim upon which relief may be granted.”

Suppression for a Bad Stop in Forfeiture Proceedings

A Fourth Amendment-based suppression motion is proper in an in rem civil forfeiture proceeding. Since civil forfeiture proceedings are quasi-criminal, the exclusionary rule applies, and suppression motions may be filed.

For example, in United States v. $291,828.00 in U.S. Currency, 536 F.3d 1234, 1236-38 (11th Cir. 2008), the court reasoned that the “Fourth Amendment exclusionary rule applies to civil forfeiture actions.”

In United States v. $493,850.00 in U.S. Currency, 518 F.3d 1159, 1164 (9th Cir. 2008), the court explained that the “exclusionary rule applies in civil forfeiture cases…. It bars the admission of evidence obtained in violation of the U.S. Constitution, as well as ‘fruits of the poisonous tree.’ ” Since the exclusionary rule applies, the res must be returned if it was improperly seized.

In many of these cases, the claimant can show the officers had no jurisdiction to make the stop and the officer had no valid purpose in making the stop. Under 21 U.S.C. § 878, the deputization of DEA officers provides that:

(a) Any officer or employee of the Drug Enforcement Administration or any State, tribal, or local law enforcement officer designated by the Attorney General may—

(1) Carry firearms;

(2) Execute and serve search warrants, arrest warrants, administrative inspection warrants, subpoenas, and summonses issued under the authority of the United States;

(3) Make arrests without a warrant

(a) for any offense against the United States committed in his presence, or

(b) for any felony, cognizable under the laws of the United States, if he has probable cause to believe that the person to be arrested has committed or is committing a felony;

(4) Make seizures of property pursuant to provisions of this subchapter; and

(5) Perform such other law enforcement duties as the Attorney General may designate.

21 U.S.C. § 878.

If the DEA agents lack jurisdiction to make the stop, the fact that the officers are acting beyond the bounds of their jurisdiction violates the Fourth Amendment.

Additionally, the claimant can often show that the way the stop was conducted was unreasonable, that the stop was unconstitutionally prolonged, or that the drug dog alert was not reliable.

The Government fails to demonstrate that the drug dog was reliable enough to justify a warrantless search of the vehicle when no dog expert was called, and no log books on the reliability of the dog were produced.

Filing a Motion for Return of Property

After the property is taken by the DEA, the owner of the property can file a claim based on the Criminal Rule of Civil Procedure 41(g) and 18 U.S.C. § 983. Rule 41(g) provides:

(g) Motion to Return Property. A person aggrieved by an unlawful search and seizure of property or by the deprivation of property may move for the property’s return. The motion must be filed in the district where the property was seized. The court must receive evidence on any factual issue necessary to decide the motion. If it grants the motion, the court must return the property to the movant, but may impose reasonable conditions to protect access to the property and its use in later proceedings.

Fed. R. Crim. P. 41(g).

Federal law, specifically the Civil Asset Forfeiture Reform Act of 2000 (CAFRA), subjects to forfeiture “[a]ll moneys … furnished or intended to be furnished by any person in exchange for a controlled substance …, all proceeds traceable to such an exchange, and all moneys … used or intended to be used to facilitate any violation” of Subchapter I of the Drug Abuse Prevention and Control Act. 21 U.S.C. § 881(a)(6).

CAFRA authorizes the government to seize all such property pursuant to 18 U.S.C. § 981(b). 21 U.S.C. § 881(b).

“Any motion for the return of property seized under [§ 981] shall be filed in the district court in which the seizure warrant was issued or in the district court for the district in which the property was seized.” 18 U.S.C. § 981(b)(3).

“Property taken or detained under this section … shall be deemed to be in the custody of the Attorney General,” but upon forfeiture, the Attorney General is authorized to transfer the property to another agency or to a state or local law enforcement agency, among other potential transferees. Id. § 981(e).5

The property owner can file a motion for the return of property in federal court. The federal civil asset forfeiture procedure includes a 60-day period in which the government is to provide notice of a seizure or to commence a forfeiture proceeding. 18 U.S.C. § 983(a)(1)(A)(i), (ii).

When the government fails to comply with the notice requirement, subject to certain exceptions not at issue here, “the Government shall return the property … without prejudice to the right of the Government to commence a forfeiture proceeding at a later time.” Id. § 983(a)(1)(F).

“The Government shall not be required to return contraband or other property that the person from whom the property was seized may not legally possess.” 18 U.S.C. § 983(a)(1)(F).

Rule 41(g) permits a person subject to federal prosecution to seek a specific remedy—the return of seized property—through equitable proceedings against the government rather than through the potentially more burdensome process of pursuing a claim against the individual officers who seized the property.

Additionally, while Rule 41(g) authorizes an order for the return of the seized property, a claim in equity based on the alleged unconstitutional deprivation of currency does not require the return of specific funds.

For example, in Perez-Colon v. Camacho, 206 Fed.Appx. 1, 4 (1st Cir. 2006), the court found that a claim for the return of currency involves equitable restitution, not money damages, and the specific currency need not be provided.

What does the DEA do with the “Drug Money” seized?

As of April 1, 2020, the DEA reported that in FY2019, it processed 9,827 Standard Seizure Forms for assets valued at the time of seizure as $593,776,760.81, and the final asset value was determined to be $584,460,979.12.

So what did the DEA do with all that money and other valuable assets seized?

The Department of Justice (DOJ) equitable share distribution report shows that cash and currency were shared with DEA’s state and local partners.

Memorandum from DEA Regarding Judicial Referral of Seized Assets

After the DEA gets your verified claim, the forfeiture counsel at DEA’s Office of Operations Management at the Asset Forfeiture Section prepares a memorandum for judicial referral of seized assets.

The memorandum lists the date, Asset ID Number, Case Number, Property Description, Claimant, and Judicial Circuit.

The DEA’s memorandum for a judicial referral is sent to the United States Attorney. Depending on the circumstances, the memo is sent to the AUSA Chief, Civil Division, the AUSA Chief, Criminal Division, or the Asset Forfeiture Coordinator.

The form has a section for DEA to check any paragraph(s) that apply to the seizure including:

___ The DEA has received a timely claim on __[date]__, for the property identified above. Your office is hereby requested to initiate Judicial Forfeiture Proceedings within ninety (90) days of the date this claim was filed with the DEA. See 18 U.S.C, Section 983(a)(3)(A).

___ A Hardship request for Release of Property was ___ granted / __ denied on _______. A copy is enclosed for your information.

___ The seized property is not eligible for Administrative forfeiture. Your office is hereby required to initiate judicial forfeiture proceedings.

___ Other:

Please note that on ____, DEA HQ received the attached claim prior to DEA sending Notices of seizures. Pursuant to 28 C.F.R. Section 8.10(f), the prematurely filed claim shall be deemed filed on the 30th day after the commencement of the administrative forfeiture preceding as defined in 28 C.F.R. Section 8.8.

As a matter of caution, DEA has accepted the attached as a valid, timely filed claim and, therefore, has referred this claim to your office for review and any action you deem warranted.

Also note that consequent to the filing of a premature claim, the advertisement for the above-listed asset(s) has not been publicized and therefore we do not have a copy at the present time. The above-listed asset(s) will be scheduled for publication on _____.

Please forward copies of complaints, indictment, and forfeiture orders to: DEA, Asset Forfeiture Section, Drug Enforcement Administration, 8701 Morrissette Drive, Springfield, Virginia 22152, and the local DEA Field Office indicated below. All correspondence should be referred to the asset identifier and the case number.

These letters often claim that telephone inquiries can be made to the DEA/Headquarters, Asset Forfeiture Section at 202-307-8555. The DEA does not list the forfeiture counsel’s phone number in the letter or online.

According to the Customer Service Center Representative at DOJ’s Forfeiture Systems Customer Service Center, the DEA Claims & Petitions support telephone number is 202-307-8555.

Sometimes, the Supervisory Program Analyst with the Asset Forfeiture Section of the DEA’s Office of Operations Management will send a letter claiming the claim is defective. The letter might explain that the DEA received a submission for the above-referenced asset by providing:

“If the submission was intended to be processed as a Claim, contesting the forfeiture in federal court, it was defective for the reasons noted below.

Accordingly, the submission is being turned to you.

The submission did not identify the specific property being claimed. See 18 USC Section 983(a)(2)(9)(i). The DEA is unsure whether you are claiming the above-listed asset. Please clarify the amount of chunky being claimed.

If the clarification and/or corrections are not made, DEA may treat the documents as nugatory, and the case shall proceed as though the documents had not been tendered. See 28 CF Section 8.10(g).

When a premature claim is filed, the letter might provide the following:

The Drug Enforcement Administration (DEA) has received the submission regarding the above referenced asset. The claim has been accepted, and this matter has been referred to the judicial district noted above. Please direct all inquiries regarding this matter to that office.

Your client filed his claim prematurely, specifically before DEA mailed notice letters to the interested parties. Your client filed a claim on [date]. DEA commenced forfeiture proceedings on [date] , by mailing notice letters on that date. Your claim is deemed filed as of 30 days after May 3, 2023, the date DEA commenced the forfeiture proceedings by mailing notices of the seizure. This rule is found in 28 C.F.R. § 8.10 (f):

“Premature filing. If a claim is filed with the appropriate official after the seizure of property, but before the commencement of the administrative forfeiture proceeding as defined in § 8.8, the claim shall be deemed filed on the 30th day after the commencement of the administrative forfeiture proceeding.”

Forfeiture Support Associates, LLC (FSA) Senior Law Clerk

After you file the claim, the DEA will send the claim and the civil judicial forfeiture referral to the Asset Forfeiture Unit of the United States Attorney’s Office in the appropriate division of the District Court.

The first correspondence might come from an employee of the Forfeiture Support Associates, LLC, known as “FSA Senior Law Clerks.” The FSA Senior Law Clerk might ask if you are amenable to a CAFRA extension to see if the case can be resolved before filing a complaint. We never agree to a continuance that would delay the time required to file the complaint.

The FSA Senior Law Clerk is a government contractor employed by Forfeiture Support Associates, LLC, assigned to the U.S. Attorney’s Office.

The FSA Senior Law Clerk is not authorized to provide legal advice on behalf of the USAO-EDNY, and the content of any correspondence should not be considered legal advice from the U.S. Department of Justice.

“Consent to Search” DEA Form 88 (Oct. 1983))

DEA agents will sometimes ask a suspect to sign a “consent to search” form (sometimes referred to as “DEA FORM 88 (Oct. 1983)”), which provides:

- I have been asked to permit special agents of the drug enforcement administration to search: (Describe the person, place or things to be searched).

- I have not been threatened nor forced in any way.

- I freely consent to this search.

Just because you signed this form does NOT mean that the court would necessarily conclude that your consent was “free and voluntary.” Instead, we can help you file a motion to suppress evidence illegally obtained if the government files a complaint for forfeiture in the U.S. District Court.

DEA’s Form for the Disposition of Nondrug Evidence (Form 48(a)(10/07))

When DEA decides to return property shortly after a seizure for forfeiture, it might use the “quick release” procedures found in 28 CFR § 8.7 – Release before claim.

In those cases, DEA might use Form 48(a)(10/07) for the disposition of nondrug evidence. The form provides that the “exhibits” in this case are no longer needed as evidence and will be:

- Returned to rightful owner: [name and address of property owner].

Other options listed in the form include:

- Transferred to another agency or DEA office (name of agency or other DEA office.

- Transferred to another inter-office DEA case (identify new case number and exhibit number).

- Placed into Title III Storage in accordance with (IAW) Title 18 USC Section 2518(8)(a), procedures for interception of wire, oral, or electronic communications (date of court order to seal: ________).

- Forfeited IAW Title 21 USC Section 881(a), disposition of forfeited property.

- Undergo abandonment proceedings IAW 41 CFR 128, authorities and responsibilities for personal property management. See Section 6681.9 of the Agents Manual. A DEA 294a is attached to this document.

- Destroyed. If Title III, date of court order to destroy: ______

- Returned to originating case file.

- Returned to DEA Headquarters (recovered official advanced funds (OAF).

Additional Resources

How the DEA Official Notification is Posted – Search the DEA legal notice published weekly on the centralized www.forfeiture.gov website for forfeiture actions across all federal agencies. The DEA must give proper notice that the property listed on the notification was seized for federal forfeiture for violating federal law. The public can find the rules, procedures, and laws that apply to the forfeiture process listed on the website or in 19 U.S.C. Sections 1602 – 1619, 18 U.S.C. Section 983, and 28 C.F.R. Parts 8 and 9.

List of Recent Official Notifications of DEA Forfeitures – Find examples of some of the most recent DEA forfeiture notifications, including information on DEA forfeiture actions pending in the Middle District of Florida and Tampa Division with the DEA case number, the amount of U.S. Currency seized, the date of the seizure, the location of the seizure, the person from whom the money was seized, and whether the forfeiture was under 21 U.S.C. 881.

This article was last updated on Thursday, May 25, 2023.